We look at what is happening in the property market during July 2024 with an update from our branches in Shawlands, Cardonald and Dunoon.

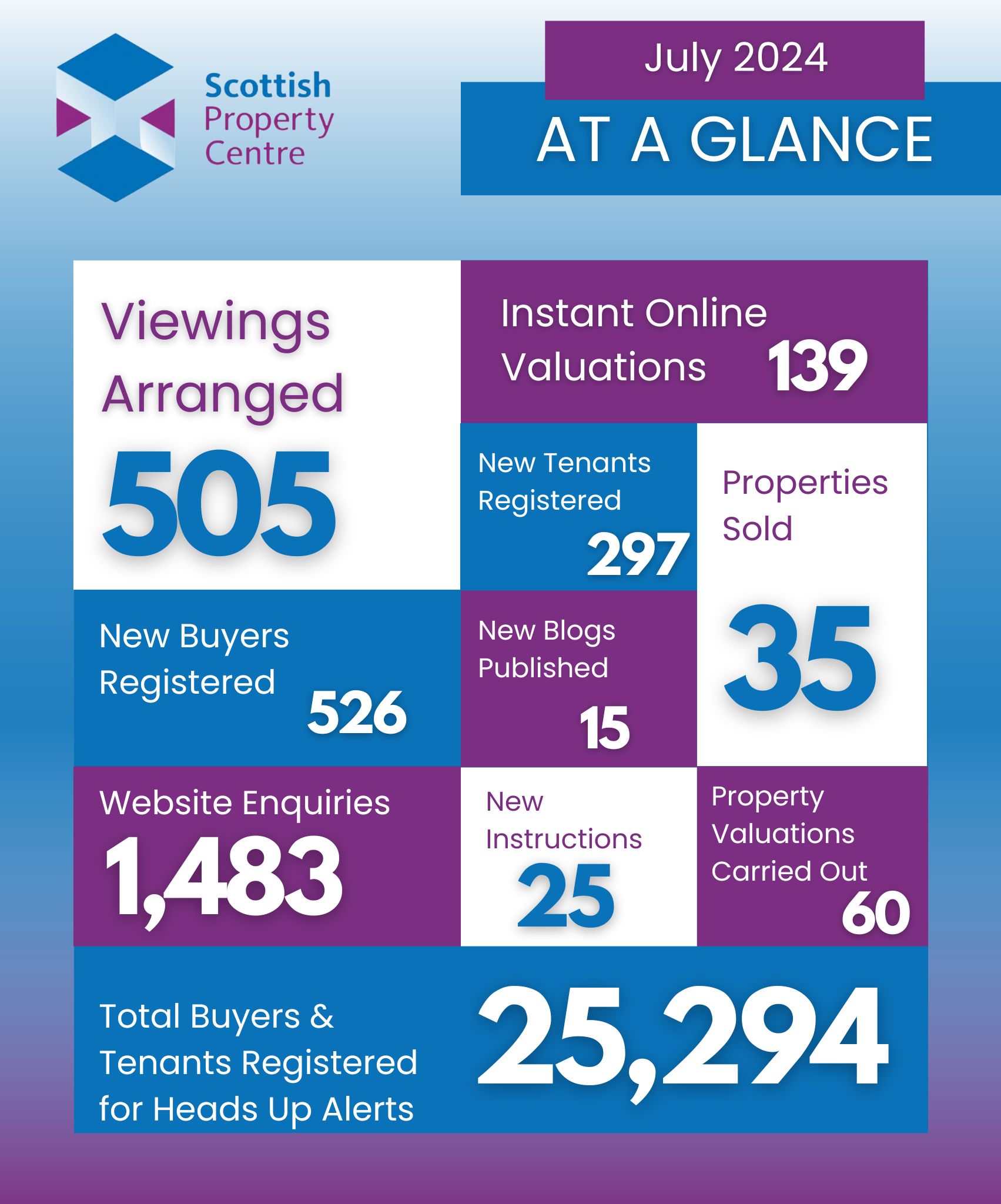

As you can see from the above snapshot of our figures for the month to date (July 1 – July 28 2024), we agreed 35 new sales with 25 new properties coming to the market during the month, significantly down from the 47 new properties coming to the market last month. This was expected with Euro 2024, the general election and summer holidays all contributing to the reduction in activity.

Buyer demand remained healthy with 526 new buyers registering during June for our ‘Heads Up’ property alerts, compared to 508 in June 2024.

Viewing figures were also up, arranging 505 viewings for our clients and received 1,483 website enquiries for their properties.

The rental market continues to be impacted by a severe supply and demand imbalance. 297 new tenants registered with us during July and we currently have 6 properties available to let.

Craig Smith from the Shawlands branch commented “During the month overall stock levels of available property reduced as the number of new properties coming to the market slowed. This is not unexpected at this time of the year as summer holidays take priority. However, over the past week we have noticed a significant upturn in valuation requests and early signs are that August will be a busy month.”

The market in the Dunoon and Cowal area continues to be buoyant and our July sales figures are the highest they have been for 4 years.

Argyll office Sales Manager, Walter MacLean stated “The properties quickly achieving the optimum sale prices are those in walk in condition, I’m happy to give our potential sellers tips and advice on how to prepare and present their homes inside and out ready for advertising.”

Here are some of our success stories during July:-

Shawlands, Glasgow branch

Pleasance Way, Pollokshaws – sold at closing date in just 7 days

Craig Terrace, Cathcart – sold well in excess of home report

Dairsie Court, Muirend – sold at closing date in just 13 days

Cardonald, Glasgow branch

Brock Road, Pollok – sold at closing date in just 8 days

Mossview Quadrant, Cardonald – sold at closing date in just 13 days

Chirmorie Crescent, Crookston – sold well in excess of home report

Dunoon, Argyll branch

13 Tigh na Cladach, Bullwood Road, Dunoon, o/o £115,000 – 1 bedroom first floor flat – sold over the home report valuation – a great example of how a small outside space can look amazing

21 Pilot Street, Dunoon – 4 bedroom detached house, o/o £245,000 – sold over home report valuation – amazing garden and immaculate interior

Fairways, Ardenslate Road, Dunoon – 4 bedroom bungalow, o/o £240,000 – pristine condition inside and out

Rightmove House Price Index

We take a look at what is happening nationally with the latest Rightmove House Price Index for July 2024.

Here are the keys takeaways from the report:-

- Average new seller asking prices drop by 0.4% (-£1,617) this month to £373,493, a bigger July drop than usual, as new sellers try to cut through the distractions of the General Election, sporting events and summer holiday season with a tempting price

- Market activity has remained steady throughout the General Election campaign, and though there are signs that some would-be movers are waiting for the first Bank of England Base Rate cut, most are continuing with their moving plans:

- The number of sales being agreed remains encouraging at 15% above the same period a year ago, when mortgage rates were approaching their peak

- The number of new sellers coming to market is a steady 3% above last year

- Buyer demand remains stable overall, but there’s a slight drop (-2%) in demand in the particularly affordability-stretched first-time buyer sector

- Current market expectations are that the first Bank of England Base Rate cut may be as soon as August or September, which would be a boost for most home-movers and bodes well for the Autumn market:

- The average five-year fixed rate is now 4.97%, which while below the peak of 6.11% in July 2023, is still much higher than the average of 2.51% in July 2021, before the first of 14 consecutive rate increases

As always, if you have any questions relating to the property market or would like to discuss the current valuation of your home, please feel free to get in touch with your local Scottish Property Centre branch.

Looking to move in 2024? Register for our ‘Heads Up Property Alerts’

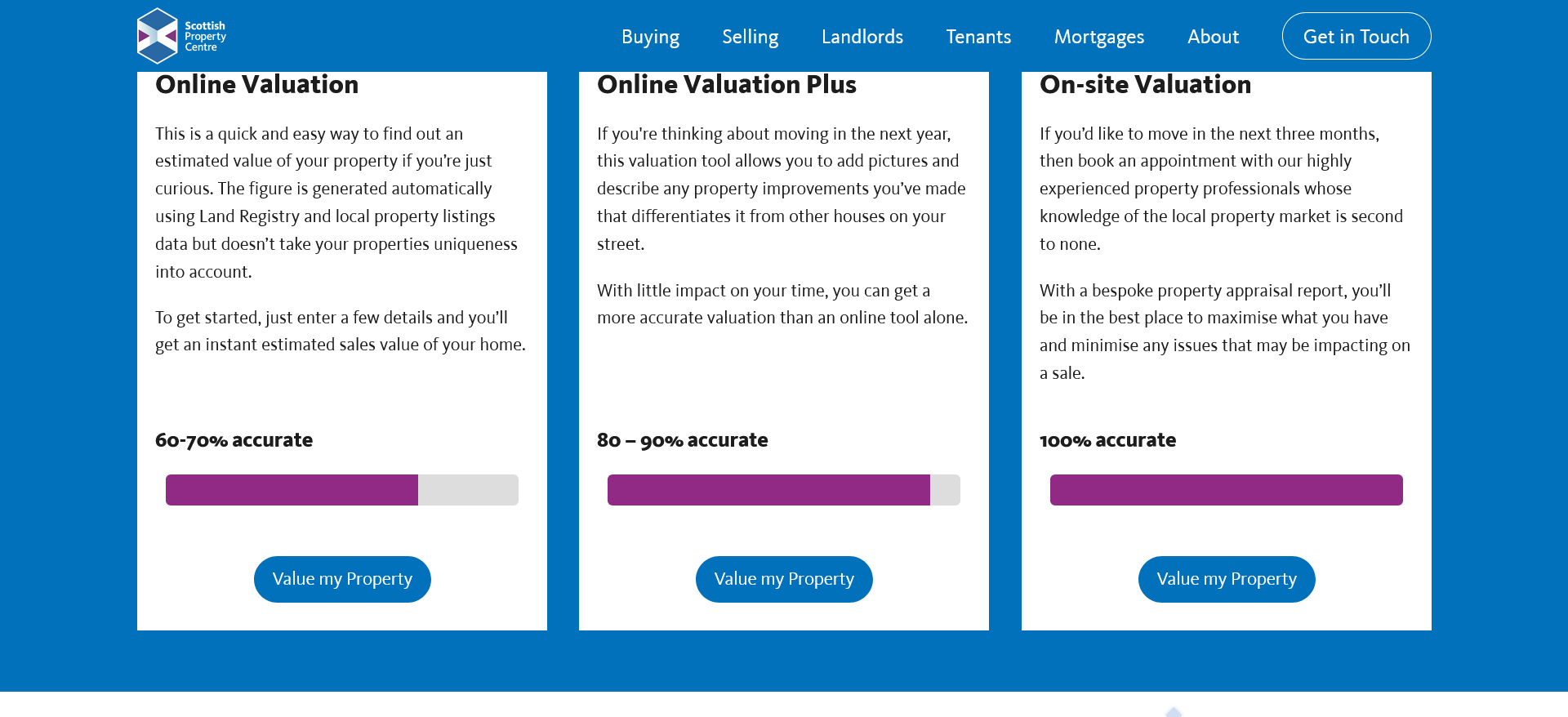

Do you know we offer 3 types of valuation? This includes an instant on-line valuation, you can get started here.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link